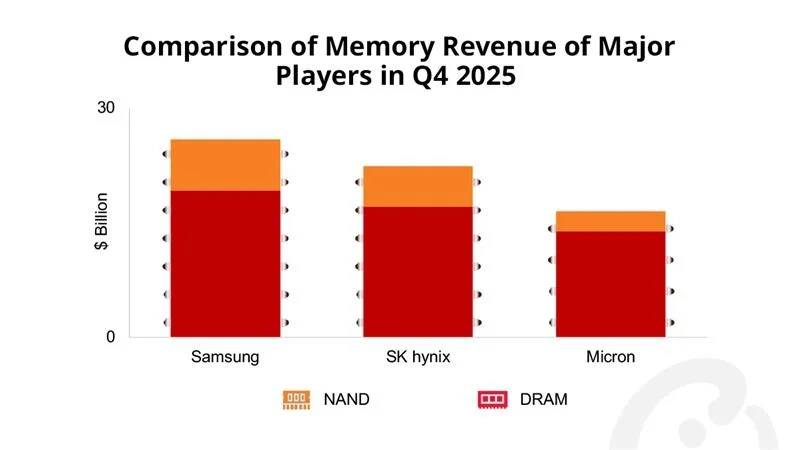

Samsung’s DRAM division just posted record-breaking numbers, pulling in $25.9 billion in Q4 2025 and accounting for 40% of the company’s total profit. That’s impressive for Samsung’s balance sheet, but it comes with a catch: the same semiconductor supply crunch driving those profits is about to make your next phone more expensive.

According to Counterpoint, Samsung’s RAM sales jumped 34% in a single quarter, pushing the company to the top spot alongside SK Hynix and Micron. The revenue includes both high-bandwidth memory (HBM) for AI applications and traditional DRAM for consumer devices.

That growth looks great on paper, but it reflects a fundamental supply problem. As demand for HBM skyrockets—driven by AI development and data centers—manufacturers are shifting production capacity away from standard memory. Less fabrication space for consumer-grade RAM means tighter supply and higher prices across the board.

The Galaxy S26 Price Hike Nobody Wanted

Samsung already hinted that the Galaxy S26 series will cost more than previous models, and semiconductor supply issues are a big reason why. Wonjin Lee from Samsung’s mobile division didn’t mince words about the situation:

“There’s going to be issues around semiconductor supplies, and it’s going to affect everyone. Prices are going up even as we speak. Obviously, we don’t want to convey that burden to the consumers, but we’re going to be at a point where we have to actually consider repricing our products.”

Translation: your next flagship phone is getting a price bump, and Samsung’s positioning this as unavoidable rather than optional. Recent reports suggest the S26 lineup will indeed launch at higher price points than the S25 series.

It’s not just smartphones. PC builders are watching DDR5 RAM prices climb significantly over recent months. While DDR5 doesn’t fall into the HBM category, it competes for the same manufacturing capacity. As Samsung and other producers prioritize more profitable HBM production for AI chips, standard memory production gets squeezed.

The irony is hard to miss: Samsung is making record profits selling the very components that are becoming scarce enough to justify raising prices on consumer products. The company benefits twice—once from selling expensive HBM to AI developers, and again by passing increased costs to smartphone buyers.

Whether consumers will accept higher prices for incremental upgrades remains the real question Samsung needs to answer.