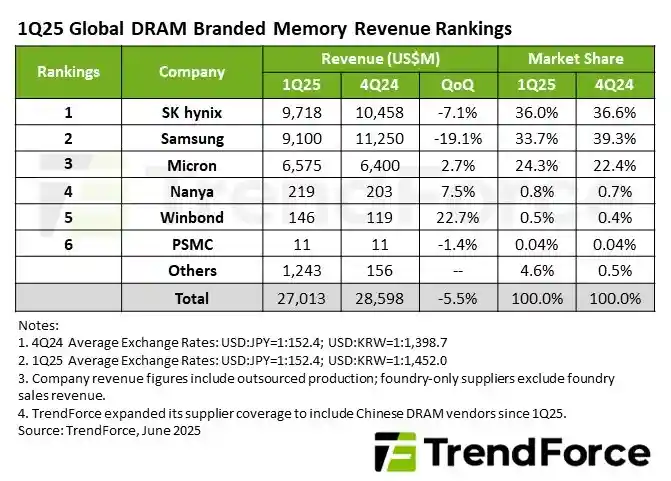

Samsung lost its leading legacy to SK Hynix, as it leads the global DRAM market despite having a growth decline in the first quarter of 2025.

The second quarter of the year is about to end, meanwhile, the market researcher Trendforce revealed that global DRAM sales totaled $27.1 billion in Q1 2025, with a 5.5% quarterly decline. The metrics pointed out that the key reason behind this growth downstream is to falling contract prices for conventional DRAM and the contraction in HBM shipment volume.

According to the metrics, the leading SK Hynix secured the first place in the global DRAM market with $9.7 billion in revenue during Q1 2025; however, it’s a 7.1% decline, since in Q4 2024 it generated %10.4 billion.

On the other hand, Samsung earned $9.1 billion in revenue during Q1 2025 with a 19.1% decline, as it generated $11.2 billion in revenue in Q4 2024. These metrics clearly show Samsung fell below SK Hynix at 33.7% in the first quarter from 39% in the fourth quarter of last year.

Apart from these two brands, Micron secured third position in the market with $6.5 billion revenue and 2.7% quarter-on-quarter growth, due to the growth in HBM3e shipments. Following these brands, there are more suppliers in the line, such as Nanya with 210 million revenue, Winbond with 146 million revenue, and PSMC with 11 million revenue.