Android 13 going strong in the market, overtaking previous versions, thanks to Samsung

Android itself is a reliability tag for any smartphone besides iPhones due to its strong privacy policy and regular security updates. That’s also the reason behind its monopoly over the whole smartphone market, which is growing rapidly day by day, even now. It is obvious if you wonder how Android’s different versions perform in the global market. Today we will move our focus to the latest Android 13’s performance. Let’s get started.

Informatively, to determine the performance of various Android versions, Google once provided monthly updates on a web page, which can now be accessed through the Android Studio development environment only. However, the web page now got slower; instead of being updated monthly, it now updates on a quarterly basis. Now let’s move to our main topic “How well has the latest OS, Android 13, performed in the market”.

Android 13: Market Statics

Notably, Android 13 made its way to the market back in August, but it first appeared in the statics in January 2023. As per January’s statics, this OS has reached more than 5% of devices in just five months, which now extended to more than 12%. Informatively, the previous Android 12 reached 13.3% of devices within a year of its launch, and it is possible that Android 13 may surpass it in nearly no time due to its speedy adoption.

Let us inform you the South Korean firm has played a huge role in Android 13’s speedy adoption as it holds remarkable market shares. Samsung also has long-lasting update support as they promised significant updates for its premium devices as well as cheaper models. At that moment, nearly all manufacturers’ top-notch models received Android 13. It won’t be wrong to say that Android 13 nearly surpassed previous versions.

Samsung has proven to be a leader in the industry thanks to its unwavering commitment to providing the latest Android updates to its devices. This dedication has paid off, as evidenced by the impressive adoption rate of Android 13. With the rollout of One UI 5, the company has once again demonstrated that it is the reigning king in this department, with more devices running Android 13 than any other brand

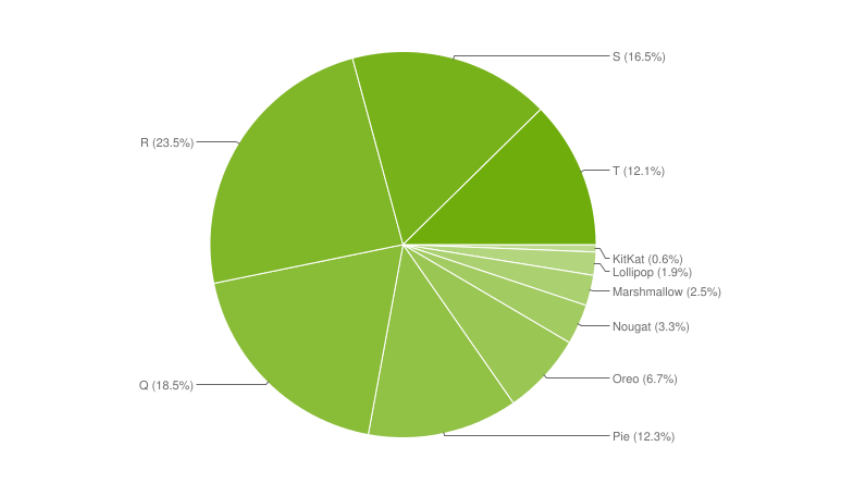

We are providing the market shares of some previous Android versions below.

- Android 13 – more than 12%.

- Android 12/12 L – 16.5%.

- Android 11 – 23.5%.

Developers should maintain compatibility

This data will surely be helpful for app developers so that they can manage their applications. Developers need to adopt the new features of the latest Operating System in order to maintain their app’s compatibility to cover the widest possible user base. Besides the compatibility, it is also necessary for developers to concerts about security updates as most devices are currently running Android 11 or previous.

It is frigid that most of the app developers aim to focus on the latest OS versions and devices only, which puts the older OS or device users’ security at risk. It is really important for all the developers they continue to provide security updates for older OS and devices as well. It will also benefit them as they can focus on newer as well as older user bases. We should wait till the next statics to know where things are going currently.

Thanks to “9To5Google“