Samsung

Samsung Takes Crucial Step To Head Off Chinese Rivals By Increasing Smaller OLED Workforce

Samsung added more staff to its production line for small OLED (light-emitting diode) panels used in smartphones as well as other portable gadgets.

Samsung leads the display panel market in South Korea. Recently, for seamless production, it increased its staff for smaller organic OLED panels, although the aim behind this rapid takeoff appears to be to compete with growing Chinese companies such as BOE Technology Group Co.

Now the Korean giants are turning their focus to smaller organic OLED displays used in smartphones, for they have decided to move a substantial portion of staff, which is 30%—nearly 500 engineers—from the large OLED panel division. This decision appears to be a be a deliberate step by giants.

The demand for smaller OLEDs is boosted and energized by new devices such as VR headsets (XR) and car displays. It appears that by 2029, it could touch $8.9 billion, whereas the market for larger OLED panels used in TVs is diminishing due to a slow TV market, and that’s the main reason why Samsung increased its workforce. Samsung made up 43% of the global active matrix organic light-emitting diode (AMOLED), a type of OLED display device for IT products, for instance, smartphones, last year, down from 56% in 2022.

On the other side, BOE increased its share to 15% from 12% during the period. Back in 2021, China snatched the leading position of Samsung by offering cheaper LCD options, giving them a major edge. Second, supported by their government and strong domestic demand, Chinese companies gained significant market share in smaller OLED panels, used in smartphones and other portable devices.

Even after the lead of China, the gap in squeezing, since back in 2022, was around 40%, but it shot down to 10% in 2023, just because Samsung and LG are still strong contenders, holding a combined 53% of the smaller OLED market share as compared to 43% of China.

Regarding all this mess, Samsung Display President and CEO Choi Joo Sun warned that it is just a matter of time for Chinese brands to catch up with South Korean makers in the OLED industry. Now both brands, Samsung and LG, are gearing up to make a significant move to regain authority in the display market. Samsung Electronics invested $3 billion last year to build a production line for laptop OLED panels to maintain its dignity, whereas LG Display plans further investment in an eight-generation production line, likely for smaller displays; however, a final decision is pending.

Samsung

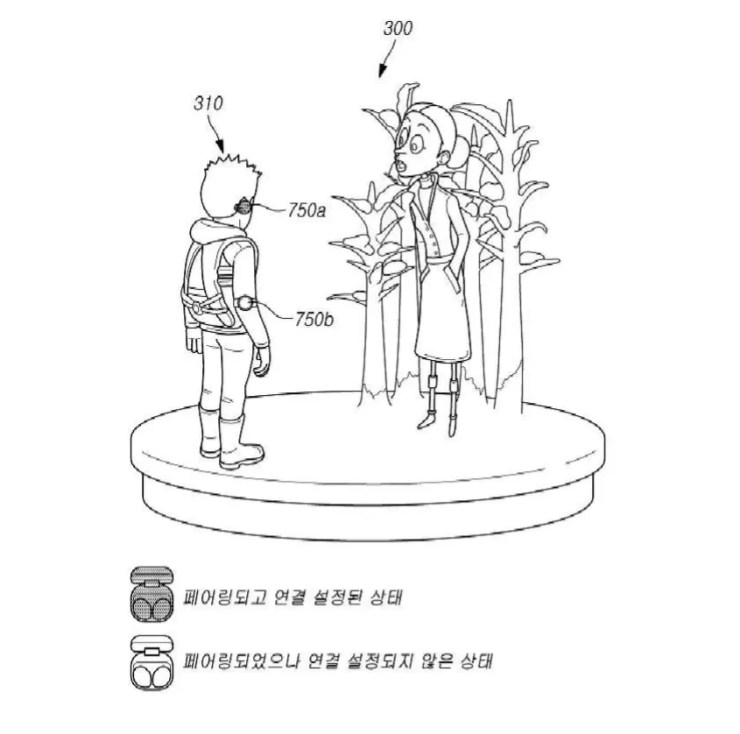

Samsung Patent Hints at Rethinking Smart Glasses like Apple Vision Pro

Samsung is a tough competitor for Apple, and now to fire up the battle, the latest patent filing is unveiling that Samsung is gearing up to introduce a new VR headset with more advanced features as compared to Apple’s Vision Pro.

The reports are reporting that the Korean giant has filed for a new patent for a VR headset. This is being speculated since patent documentation has been spotted, which is suggesting that Samsung’s VR headset could be better than Apple’s Vision Pro.

It is expected that the forthcoming VR headset will arrive with infrared sensors for augmented reality and offer similar features as Apple’s Vision Pro. The patent has been filed at the Korean Intellectual Property Office with the description “Communication methods and apparatus utilizing avatars in virtual space.”

According to the document, it appears that the headset can showcase virtual avatars to the user by using multiple sensors to collect information from their surroundings. However, here is a noticeable fact: the patent does not mention the word headset anywhere. In place of that, it hints at any gadget that can be worn by the user.

The reports are saying that the headset will work smoothly with Samsung wireless headphones and smartwatches. It can probably gather health data, such as heart rate and calories burned, from connected devices to create a virtual avatar for fitness activities. The brand could also attach various sensors, such as accelerometers, gyroscopes, and even infrared sensors. These would track your movements and locations exactly.

The documents also mention the possibility of an integrated navigation system, Wi-Fi, and Bluetooth support. The device could also have its own processor, GPU, and NPU to manage this data. The giant could also attach a rechargeable battery, although at the moment, the exact position of the battery placement in the device is not mentioned.

However, the brand has yet to officially announce the development of a forthcoming VR headset.

Samsung

Samsung TV Plus Expands with US Sports, Music, Family & Entertainment

Samsung Ads made a two-pointed pitch at the IAB NewFronts to consumers and advertisers to enhance their experience.

The Korean brand ‘Samsung’ is now offering new premium content to its free streaming service, Samsung TV Plus,across various genres for consumers. On the other side, Samsung Ads is using artificial intelligence just to offer improved ad targeting and results. The giant foregrounds its strong market position as America’s first choice for TV and the undisputed global leader for 18 years, continuing to innovate and transform living rooms in central hubs.

Samsung is now setting up to expand its investment in the Samsung TV Plus service with an all-new premium programming partnership. The service, which grew more than 60% year-over-year, announced a suite of major league channels that will deliver live sports from Major League Baseball (MLB) and more. The detailed information is mentioned below.

- MLB: Samsung TV Plus is collaborating with Major League Baseball (MLB) to debut a new MLB FAST channel. Although this channel will not offer live games, it will offer baseball fans weekly game replays, Minor League game replays, game recaps, and other exclusive content.

- PGA TOUR: This will offer total coverage of all things PGA TOUR, with behind-the-scenes programming, documentaries, tournament recaps, highlights, competitions, and so on.

- AHL: Once this report comes into practice, Samsung TV Plus will be the first FAST platform to air live American Hockey League games through the Los Angeles Kings affiliate, the Ontario Reign.

- Formula One Channel: The Formula 1 Channel is the best destination for fans to catch up on all the actions from F1, F2, F3, and F1 Academy races throughout the season, including analysis, replays, and documentaries.

- One Championship TV: The debut of ONE Championship TV will introduce combat sports content to the service. Featuring unique live events on TV Plus, highlights, series, and behind-the-scenes access from the world’s largest martial arts organization,.

Apart from these, for the music enthusiast, Samsung TV Plus is announcing an exclusive partnership with Warner Music, which will boost the approximately 500 existing premium national and local channels already on Samsung TV Plus. Warner Music content will appear in Samsung TV Plus’ recently launched dedicated music destination and will feature exclusive music playlists, for instance, The Drop and Artist Odyssey.

Samsung Ads is stretching its suite of AI-powered performance solutions, Smart Outcomes, with two new solutions, Smart Acquisition and CTV to Mobile, to make advertising smarter with smart outcomes.

Samsung

Galaxy AI Powers Samsung’s Smartphone Sales Surge

Samsung Electronics has disclosed the financial results of its Q1 2024; fortunately, the results are mesmerizing, as the mobile division was upbeat by Galaxy S24 sales.

The Korean brand debuted the Galaxy S24 flagship series in January earlier this year, bringing a slew of Galaxy AI novelties to the phones and older flagship devices. It is reported by Samsung’s mobile and network division that they have won 3.51 trillion of operating profit in Q1 2024, around ~$ 2.54 billion.

It was already reported, again, that the same fact has come into existence: Galaxy AI, a power package of generative AI features, is the key reason behind the sales growth. The brand states that it has decided to bring these AI features to other flagship phones in Q2 2024, but also promises that “it will continue to invest in research and development to further expand and refine Galaxy AI.”

The brand is already all set to debut a bundle of new Galaxy devices at Galaxy Unpacked Event 2024 in July, including the Galaxy Z Fold 6, Galaxy Z Flip 6, the Galaxy Tab S10 series, the Galaxy Watch 7 line, and the Galaxy Ring. Samsung is not the only firm actively working on generative AI features, as AI has become increasingly important in the smartphone industry. Other smartphone manufacturers, such as Google, Xiaomi, OnePlus, OPPO, and more, are also actively looking forward to generative AI facilities.

It appears that the increase in investment also comes after a report that the

Galaxy S25 series would run Google’s Gemini Nano 2 machine learning model. Presently, the current version of Gemini Nano authorizes on-device AI features like recorder summaries and Smart Reply in Gborad.